The Advice

Energy buyers should sit out short term price “spurts” before locking away fixed prices for no longer than 12 months, according to a monthly price risk prediction from BuyEnergyOnline, the online energy market for businesses buying electricity and gas.

Globe watch: need-to-know background

In Europe, Mario Draghi the President of the European Central Bank (ECB) took markets by surprise by triggering a ‘whatever it takes’ rally last Thursday, notes BuyEnergyOnline, creating expectation of euro monetary actions this week to counter the Spanish and Italian sovereign debt crisis.

In the Middle East, escalation of violence in Syria and the bombing of Israeli citizens in Bulgaria saw volatile oil prices bounce as low as $90 and then spike above just $107.

In Asia, Japan continues to compete with the UK for Qatar’s LNG to cover their offline nuclear generators, underpinning high UK gas prices.

The UK also saw OFGEM announce more investment in combatting climate change, with £22 billion of further upgrades of gas pipelines and electricity transmission infrastructure.

What happened with energy prices?

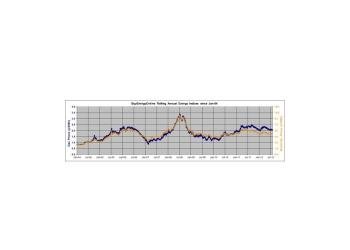

After rising at the beginning of July, UK gas and electricity prices were steady throughout the month said Derek Myers, the head of BuyEnergyOnline: “Monetary stimulus actions by China, Europe and UK drove prices higher at the start of the month. This was supported through the month as speculation of US Fed monetary action increased culminating ahead of this week’s Fed meeting.”

Mr Myers added: “Gas and electricity prices were steady at 2.10p/kWh and 5.27p/kWh. Oil prices rose 10.7% to $106/barrel, coal prices rose 4% to $94.50/tonne and carbon permits fell 16% to €6.90/tonne.”

The Prediction

Steady prices could see a “short spurt”, rocked this week by any monetary policy action from the USA and ECB, advises BuyEnergyOnline.

Mr Myers added: “It’s too late to move prior to any aggressive monetary policy actions taken this week. So if these steps are taken, best to wait until the market retraces any short-term increases. Within this grim economic environment we would recommend using flexible purchase contracts to buy gas and electricity on a month-by-month or day-by-day spot basis.”

Visit www.buyenergyonline.com to view the full Report or contact Mike Chan on [email protected] or 07769972189 for any questions.