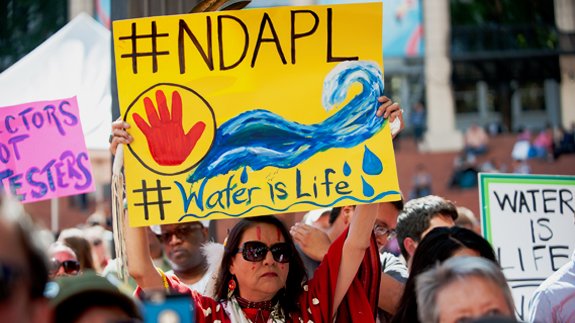

Global investors have called on banks financing the Dakota Access Pipeline to support rerouting it.

A coalition of more than 130 investors representing around $685 billion (£551.2bn) in assets want financial institutions to address the Standing Rock Sioux Tribe’s request to move the planned pipeline outside of their treaty territory.

They hope to reach a peaceful solution that’s acceptable to all parties.

Lead investor Boston Common Asset Management is joined by Storebrand Asset Management, Calvert Research and Management, First Peoples Worldwide, CalPERS and the Comptroller of the City of New York.

The investor group said there are long term reputational and financial risks for banks with ties to the controversial project, resulting from consumer boycotts and possible legal liability.

Already, consumers have closed bank accounts worth more than $66 million (£53.11m) and are threatening to pull another $2.3 billion (£1.85bn) from the banks financing the pipeline.

For example, the City of Seattle voted unanimously to sever its ties with Wells Fargo over its involvement, potentially divesting $3 billion (£2.41bn).

Rebecca Adamson, President and Founder of First Peoples Worldwide, said: “The fight against the Dakota Access Pipeline has implications beyond the Standing Rock Sioux Tribe.

“It is a fight for everyone who wants clean air, clean drinking water and a voice in what happens in their backyard. As governments increasingly prove incapable or unwilling to protect these things, citizens are turning to the market and the market is responding.”

President Donald Trump recently revived the controversial project.