Businesses overwhelmingly still believe in a net zero future after the Covid-19 pandemic.

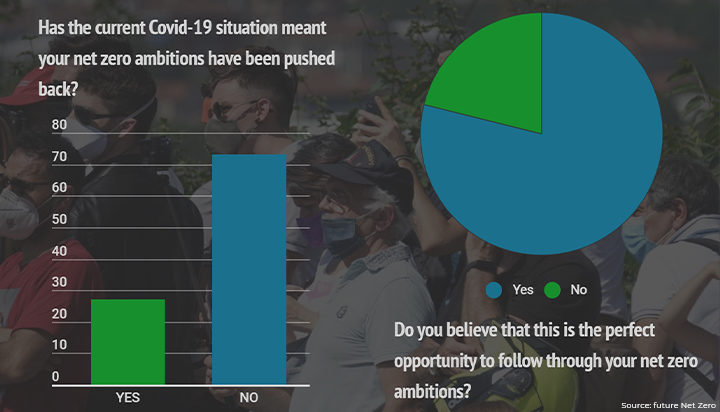

That is the conclusion of our survey of future Net Zero readers, with almost three-quarters (73%) believing it has not pushed back their ambitions as an organisation to reach net zero.

Despite the tougher economic conditions predicted after the pandemic, 78% believe this is the perfect opportunity to capitalise on net zero plans. And when asked, if we are at a net zero reset, should business lead the change? Again, a huge majority of 79% said yes.

Overall, more than a fifth of those surveyed (22%), said coronavirus had pushed back their net zero commitments and of those, 51% had no idea how long the delay would be, while 24% believed a delay of at least one year was likely.

Although bullish about the overall goal, there remain concerns about the economic downturn, with a significant feeling of trepidation at what lies ahead.

But in conclusion, I think this shows that we are now on a pathway to net zero which business not only believes in, but actively supports – that is positive news.

We know that businesses can lead in the transition and future Net Zero is your platform to unite and do so. I hope you will continue to engage and support us in this ambition. You can start by listening to our series of webinars on this very topic which will be running all week.

Our first one is at 11:00 today in which I will be speaking to Gab Barbaro, MD of British Gas Business, and Sul Alli, Director of Safety, Strategy and Support at UK Power Networks. I do hope you’ll join us throughout this week.

Here’s a full breakdown of our findings;

Business backs net zero

Overwhelmingly our readers believe the ambition for net zero is not going to be set back significantly by the current coronavirus pandemic. Some clear trends on the reasons for the positivity were apparent;

- Net zero is inherently better for the environment and cheaper – it is in businesses own interests as both suppliers of net zero services and those end-users wanting to obtain long term net zero goals. It’s clear net zero actions are part of the immediate short term goal of cost-saving.

- Government needs to show leadership in this regard and focus on ensuring a return to work in which we learn from the lockdown and ensure net zero pathways and policies are available and supported.

- The benefits of working from home, less commuting, etc are all inherently contributing to net zero in their own way and the benefits are now very clear for business to see.

Lead the way

Business should lead the transition in this time of crisis, according to 79% of respondents, with the majority saying they need to show ambition for their own staff and wider society, in addition to commercial reasons.

Why now?

Incredibly 78% also felt this was the right time to act, even with economic pressures. The reasons for this confidence included;

- A tougher economic background makes it easier to develop sustainability business cases with cost savings.

- Businesses will be looking to find efficiencies- it’s about identifying how to frame sustainability opportunities in the right manner.

- Confidence in finding funding low carbon assets for business.

- Encourage businesses who have benefited from government support mechanisms to sign up to a formal net zero commitment as part of their loan or grant schemes received from the COVID support mechanisms.

- Making greater use of the confidence in technology to deliver meetings/ cut travel.

- Saving money has to be a business KPI more than ever and net zero goals align with that.

Timeframe for uncertainty?

It wasn’t all positive news however. Overall, a fifth of our survey (22%) did believe net zero plans would be affected negatively by the fallout from the pandemic. Of those, the majority (51%) said they had no idea of the timeframe of this until the lockdown ended, while 25.5% predicted a delay of a year at least.

The reasons for these views varied from:

- Business aims were short term only and focused on cash preservation and no sign-offs were expected on net zero investments.

- Covid-19 response overtaking all other activities.

- Teams having been furloughed.

- Retrofit supply chain having been suspended so work cannot continue.

- Lack of confidence to invest in the next year.

- Governance issues hindering net zero.

Who spoke?

Our survey seemed to be polarised by either respondents in SMEs or those in very large corporates, with less feedback from the mid-market sector.

Conclusion

There is hope for the future when it comes to net zero and we have some clear trends from our survey results in three areas.

Firstly many see this as a business opportunity, which is encouraging. The use of technologies like biomass, using procurement tools to buy fair greener energy, the value of being a net zero brand and using this time to push company boards to accept changes as they need to be more adaptable, were all reasons cited for the confidence.

Secondly, many believe coronavirus has forced behaviour change which can be capitalised upon now. Homeworking, less travel, more digital connectivity and integrated fast decisionmaking were all common themes. Businesses seem to be more open to trying new things and most want the government to push financial recovery levers that favour net zero policies and practices.

And finally an environmental and social benefit – the pandemic has encouraged us to all think more about wider society and the planet we live on. Our business people feel it shows the cost of not acting now on net zero, enhanced community spirit has invigorated many and most are looking at waste and the cost of daily actions once thought essential but now proven not to be.

The future can be net zero and we should rise to the challenge even as we deal with the current crisis.

My thanks to Harry Matyjaszek for the statistical analysis in this report. Our survey was conducted between 1-22 of May. There were 215 respondents among which 42% had <50 employees) and 39% had > 1000+ employees.