After a volatile July 2019, driven by a number of factors, but mostly political events in the middle east, UK energy prices ended the month up 5-10%. Temperatures were generally above seasonal norm, though LNG deliveries were slightly reduced at a time of a busy gas-infrastructure maintenance schedule.

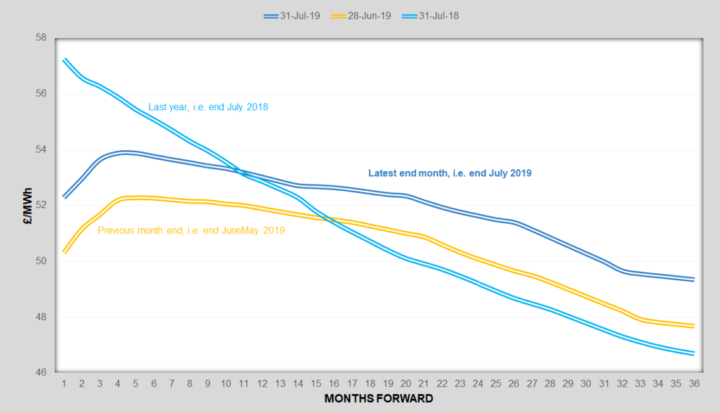

Whereas both power and gas price curves shifted up, the forward curves for rolling annual prices maintained their structure, contango at the prompt end of the curve and, further forward, both gas and power are reflecting an undying uncertain position; power demonstrating a more supported longer-term sentiment – overall the market still looks well supplied but increasingly nervous.

Gas:

Gas prices were stable for the first week of July 2019, before taking a hike up as several oil related incidents spooked the market on fears of a serious escalation in the political tensions with Iran. With both UK and Iran seizing cargo ships, the market became increasingly concerned there could be some significant disruption to oil and gas (LNG) supplies from the middle east. Whereas the situation has not been resolved yet, the market calmed down on the realisation that the market is currently over-supplied. Nevertheless, the market retains a risk premium, which will help exaggerate any market moves for the immediate future.

End month prices were up pretty much across the forward curve, albeit the forward structure of the rolling annual prices hardly changed. The gas-infrastructure maintenance season is currently in full swing, and whereas supplies are still healthy, there is less room for sudden swings in demand.

Accordingly, the gas market is quite sensitive to changing wind conditions, especially if it impacts on wind-power generation levels, in which case additional gas-fired power generation will be required. During the next month, there will be a lot of attention on gas storage levels to see if the current high EU storage levels can be maintained and the likely knock-on impact to this winter’s prices. Any Brexit related weakening of £/€, will provide further upward pressure on prices, however, current indications are still that prices will be under downward pressure for this winter.

Power:

Movements in UK power prices were again consistent with gas, though perhaps slightly more exaggerated. The forward curve for rolling annual prices generally saw a parallel shift up, indicating sentiment was little changed though starting at a higher level. Whereas the market structure is very different to last year, one consistent factor, is the increasing demand form air-conditioning – in the USA this creates a summer peak though while not the case in UK, it may only be a matter of time.

Power prices were also helped up by a surge in fixed contract covering, probably inspired by the increased political rhetoric and tensions, creating nervousness in the market, and so encouraging fixed-price contract buyers to rush – the lesson here though is to not buy on the initial news but to wait until the market calms down, or better, to spread the purchase over a few weeks.

Oil:

Oil prices ended the month pretty much where they started (or even slightly lower), despite the middle-east tensions – it is interesting to note there seemed to be a greater impact on gas and power than on crude oil. Nevertheless, backwardation did increase slightly, indicating some future upward sentiment. However, most analysts currently believe the supply position for crude oil is easier than last year and are not expecting large price rises without significant supply disruptions.

What’s the outlook?

While we have seen some volatility of late, it is worth reflecting over the past few months, during which time forward years and seasons (apart from two spells – one down and one up) have remained relatively stable, whereas at the same time the front season and months have dropped. This is a consequence of the contango in the early part of the rolling annual forward curve, as contract months roll down it. The current structure of both the power and gas markets would suggest this will continue, though as we move into the winter months, we shouldn’t expect the front month to continue to price out quite as low.

The other point to note here, if clients need to contract on a fixed basis, in the current market, both structural analysis and technical analysis suggest extending purchases for two or three years would be sensible, as there is a risk the contango will continue to develop, pushing up the far forward years (starting beyond April2021). While fixing prices early can help budget certainty, the timing of such purchases is crucial – during July 2019, those who rushed in to buying October-start years when the news of the Iranian ship hi-jacking first broke, could have experienced an up to 10% impact; this is a classic representation of the risk of buying fixed all at one time. Flexible strategies can be restricted and designed to be bespoke for a customer to minimise such risk and preferred strategies can be discussed with the Pulse account manager.

So, with the market holding it’s contango for the current winter, flexible strategies that allow delaying purchase decisions will be taking their advantage and should continue to bear fruit over the coming months. Nevertheless, it will be prudent to keep an eye on the gas storage situation, checking whether levels are remaining high. Also, because of the middle-east risk premium, it would be sensible to not leave purchases too late.

At Pulse, we are always keeping a close eye on the energy market and to see how we may be able to help you with our energy broker services, please click here